Note

Dec. 10 update

The nicotine tax has been removed from the Build Back Better bill—but that doesn't necessarily mean it's gone forever. The tax could still be added back to the bill.

Continue to contact your elected officials using the call to action linked below to educate and remind Congress that millions of Americans depend on reasonably priced vaping products to avoid smoking.

Note

Nov. 19 update

The Build Back Better bill passed the House of Representatives today by a 220-213 vote. No Republicans voted in favor of the nearly $2 trillion bill. It will now go to the Senate, where the legislation will need all 50 Democratic senators' votes and the Vice President's tie-breaker to pass.

As explained in the article below, a small number of Democratic senators have indicated they oppose certain components of the bill, including the nicotine tax. Opposition to the tax by any Democratic senator would probably lead to the tax language being removed from the final bill. But no senator will buck their party to oppose a popular position unless they hear from constituents who agree it should be opposed.

You can contact your senators using CASAA's call to action to ask them to oppose the nicotine tax that punishes people who have quit smoking, and will prevent others from doing the same.

Nov. 11, 2021

During months of debate by congressional Democrats over the Build Back Better Act that contains much of President Biden’s “social infrastructure” plan and the funding to pay for it, a proposal to tax cigarettes and other nicotine products was included in the bill, then removed, then finally added back without the cigarette tax.

The current version of the nicotine tax applies only to vaping products and nicotine pouches, and they will be taxed at a higher rate than cigarettes if the tax language stays in the bill and it passes.

House Budget Committee Chairman John Yarmuth reinserted the nicotine tax (minus the doubled federal cigarette tax) during markup of the current House version of the $1.75 trillion bill. The tax was added back to make up for lost revenue after Democrats agreed to dump certain estate-planning loopholes for billionaires—”replacing a tax that was highly progressive with one that is highly regressive,” according to Sara Sirota and Ryan Grim of The Intercept.

The White House does not oppose the new version of the tax, according to the Wall Street Journal. Despite repeated promises that Biden would not approve increased taxes on Americans earning less than $400,000 a year, WSJ says the administration believes “the proposed tax increase doesn’t violate that pledge because vaping isn’t a required cost for families.”

Cigarettes aren’t a “required cost” for families either of course—but the White House opposed that regressive tax increase. The nicotine tax, like all so-called sin taxes, is regressive because it would only hurt low- and middle-income people. The few wealthy users of vaping products and nicotine pouches would not be affected at all by the tax.

Possible Senate opposition needs to be encouraged

With the White House on board, and willing to help Congress break President Biden’s repeated promise not to increase taxes on low- and middle-income Americans, preventing passage of a draconian tax on non-combustible nicotine users will fall to Democrats in the Senate.

The BBB bill has no Republican support, and can only be passed (if it is passed at all) through the budget reconciliation process, which requires a simple majority in both houses of Congress. The House of Representatives appears ready to pass it with the nicotine tax included, but a small number of Democratic senators have expressed concerns over the cost of the bill, and a few have said they oppose the nicotine tax.

The bad news is that, as a vote on the BBB Act gets closer, senators will face incredible pressure to support any bill backed by party leadership and the White House. The good news is that it will just take one Democratic senator to stop the tax by demanding it be removed.

Senators Joe Manchin (West Virginia), Catherine Cortez Masto (Nevada), and Kyrsten Sinema (Arizona) have indicated they don’t support a tax primarily on nicotine vaping. But that isn’t written in stone, and additional emails from constituents could help them firm up their stand against the unfair, business-killing nicotine tax.

It’s important for every vaper to contact their elected officials to express opposition to the proposed Build Back Better Act nicotine tax—but emails from residents of Arizona, Nevada and West Virginia are especially crucial at this moment.

Contact your U.S. senators and representative using the updated CASAA call to action

Seven expert health economists argue against the tax

In a Nov. 8 letter to Congress, Georgia State University economics professor Michael Pesko argues that the nicotine tax currently included in the Build Back Better bill would “increase cigarette use across all populations and cause significant public health harm.” The letter echoes the findings of previous Pesko research, including a paper published in September.

Pesko has done extensive analysis of vaping product taxes, showing that e-cigarettes and combustible cigarettes are economic substitutes. That means when the price of vaping increases, more people smoke—and vice versa.

In his letter to Congress, Pesko lists several of his findings relevant to the proposed nicotine tax:

would reduce teen e-cigarette use by 2.7 percentage points, but that 2 in 3 teens who do

not use e-cigarettes due to the tax would smoke cigarettes instead. This would

result in approximately a half million extra teenage smokers overall. This finding that

teens substitute to cigarettes in response to e-cigarette taxes has also been documented

using National Youth Tobacco Survey data.

and reduce adult e-cigarette users by a similar number.

cigarettes are sold instead.

smokes cigarettes instead.”

The letter was also signed by six other health economics researchers, including Yale’s Abigail Friedman, who earlier this year published a paper showing San Francisco’s 2019 flavor ban increased cigarette smoking among that city’s high school students.

The nicotine tax is a prohibitionist’s dream

The Build Back Better Act proposal would establish the first federal tax on vaping products and nicotine pouches by taxing nicotine bought by manufacturers at the rate of $50.33 per 1,810 milligrams of nicotine—or 2.8 cents/mg.

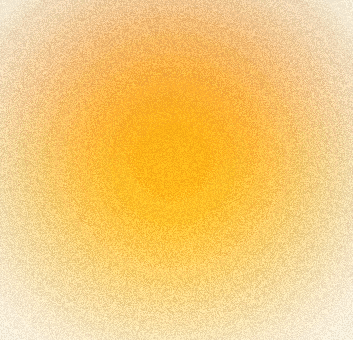

The tax would punish all vapers, but it would hit open-system product users especially hard. While a four-pack of JUUL pods would increase by $4.62, the tax would add $20.16 to the retail price of a 60 milliliter bottle of 12 mg/mL e-liquid (which contains 720 mg of nicotine). A 30 mL bottle of 50 mg/mL nicotine salts-based vape juice would cost vapers an additional $42, and the price of a liter of 100 mg/mL DIY nicotine—the most common strength—would skyrocket by $2,780!

In states that already tax vaping products based on the wholesale cost to distributors—like California and Illinois, among others—the federal tax will also increase the state tax, because the state tax is assessed based on the price distributors would pay (which would already include the federal tax). According to the Tax Foundation, retail vaping product prices would be increased significantly by this “tax on a tax.”

The tax is expected to bring in about $10 billion over the next 10 years—a drop in the bucket when legislators must fund $1.75 trillion in expenditures. (The original tax, which included a doubling of the $1/pack federal tax on cigarettes, was expected to raise $96 billion over 10 years.)

The $10 billion figure may well be fantasy. Tobacco taxes rarely perform as promised, and such a crushing tax would send many vapers and small manufacturers to an expanding black market, which contributes nothing to the government’s coffers. Many other vapers would return to smoking.

Legally compliant small- and medium-sized vaping businesses—already pushed nearly to the limit by the FDA’s broken PMTA process, the U.S. Mail delivery ban, and threatened regulation of synthetic nicotine—would be shattered by such a tax. The only stakeholders who would benefit from passage of the BBB nicotine tax are tobacco companies, who would make money whether customers choose their e-cigarettes or switch back to the Marlboros and Camels that are those companies’ core business.

E-liquid price infographic courtesy CASAA

Jim McDonald

Vaping for: 13 years

Favorite products:

Favorite flavors: RY4-style tobaccos, fruits

Expertise in: Political and legal challenges, tobacco control haters, moral panics

Jim McDonald

Smokers created vaping for themselves without help from the tobacco industry or anti-tobacco crusaders, and I believe vapers and the vaping industry have the right to continue innovating to give everyone who wants to use nicotine access to safe and attractive non-combustible options. My goal is to provide clear, honest information about vaping and the challenges nicotine consumers face from lawmakers, regulators, and brokers of disinformation. You can find me on Twitter @whycherrywhy