Dec. 7, 2022

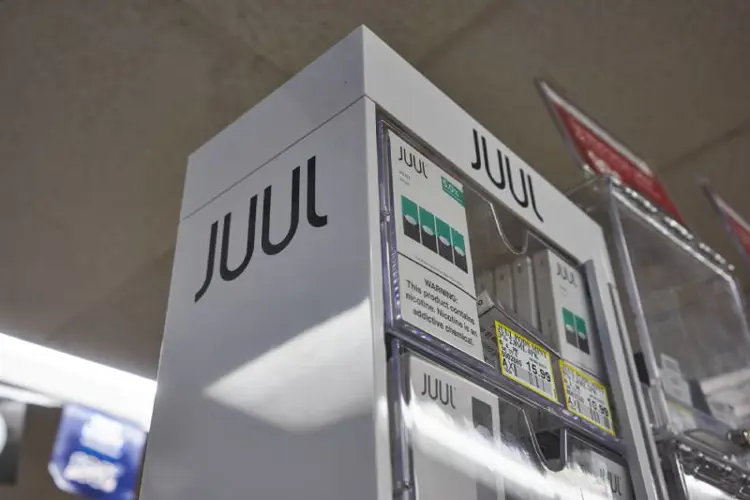

Juul Labs has reached a financial settlement with more than 10,000 individuals, municipalities, school districts and American Indian tribes that sued the company on a variety of grounds. The lawsuits included racketeering allegations against the company and some Juul Labs directors.

The company announced yesterday that the settlement covers more than 5,000 actions against Juul, including personal injury, consumer class action, government entity, and American Indian tribes. The company said the agreement prevents Juul from disclosing the settlement amount at this time.

Most of the lawsuits had been consolidated into a huge multi-district litigation (MDL) in the Northern California U.S. District Court, presided over by Judge William Orrick III. The first bellwether case from the MDL was scheduled to be heard in January 2023.

New investments cover the settlement cost

Beset by legal challenges and FDA hostility, Juul Labs recently explored the possibility of bankruptcy, but the company now says it has “taken a series of steps to stabilize its business operations.” According to the Wall Street Journal, Juul has received new equity investments that will cover the cost of the settlement and allow the company to move forward. (An equity investor receives an ownership stake in the company.) Juul has also reportedly trimmed its staff by a third as part of its cost-cutting measures.

The agreement comes three months to the day after Juul agreed to pay more than $438 million to 33 U.S. states (and Puerto Rico) to settle claims the company marketed its JUUL pod vape to youth and deceived consumers about its addictiveness. The company had previously settled individually with four other states. It still faces lawsuits brought by some other state attorneys general.

Plaintiffs’ lawyers told the New York Times the settlement does not cover claims against Altria, which owns 35 percent of Juul Labs. Altria recently ended its non-compete agreement with Juul, claiming the e-cigarette manufacturer’s value had dropped below 10 percent of Altria’s original $12.8 billion investment. Altria could become a Juul competitor by buying an existing vape brand like NJOY or launching new products.

Juul still faces FDA hostility and a changing marketplace

With its legal woes mostly solved, Juul could now become a target for a larger company like Altria or Philip Morris International (PMI). PMI is entering the U.S. market for the first time after its purchase of ZYN nicotine pouch manufacturer Swedish Match, and will soon also sell its heated tobacco product IQOS in the U.S.

Neither Altria or PMI currently have FDA-authorized vaping products to sell, and submitting new products to the FDA for successful premarket review can take years. It's pure speculation, but it seems like purchasing an existing brand might be an attractive option for those companies—especially a popular brand with little outstanding legal liability.

Of course, Juul’s products also haven’t been authorized yet by the FDA. In June, the agency issued a marketing denial order (MDO), ordering Juul off the market immediately. The company received a temporary stay of the order the next day in federal court, and less than two weeks later the FDA backed down and put the MDO on hold while Juul’s premarket tobacco application (PMTA) is re-reviewed.

Juul continues to sell its products without authorization, waiting for the FDA to decide whether it will follow the science and give Juul a green light, or continue its childish and politically motivated vendetta against the company. If the FDA reaffirms its marketing denial, Juul will face a protracted legal fight and could be forced off store shelves.

Juul has also struggled in the marketplace recently, losing its top spot in the convenience store vape segment to R.J. Reynolds’ Vuse Alto device, and fighting a losing battle against hundreds of gray market disposable vape products that ignore the FDA flavor restrictions.

The Freemax REXA PRO and REXA SMART are highly advanced pod vapes, offering seemingly endless features, beautiful touchscreens, and new DUOMAX pods.

The OXVA XLIM Pro 2 DNA is powered by a custom-made Evolv DNA chipset, offering a Replay function and dry hit protection. Read our review to find out more.

The SKE Bar is a 2 mL replaceable pod vape with a 500 mAh battery, a 1.2-ohm mesh coil, and 35 flavors to choose from in 2% nicotine.

Because of declining cigarette sales, state governments in the U.S. and countries around the world are looking to vapor products as a new source of tax revenue.

The legal age to buy e-cigarettes and other vaping products varies around the world. The United States recently changed the legal minimum sales age to 21.

A list of vaping product flavor bans and online sales bans in the United States, and sales and possession bans in other countries.